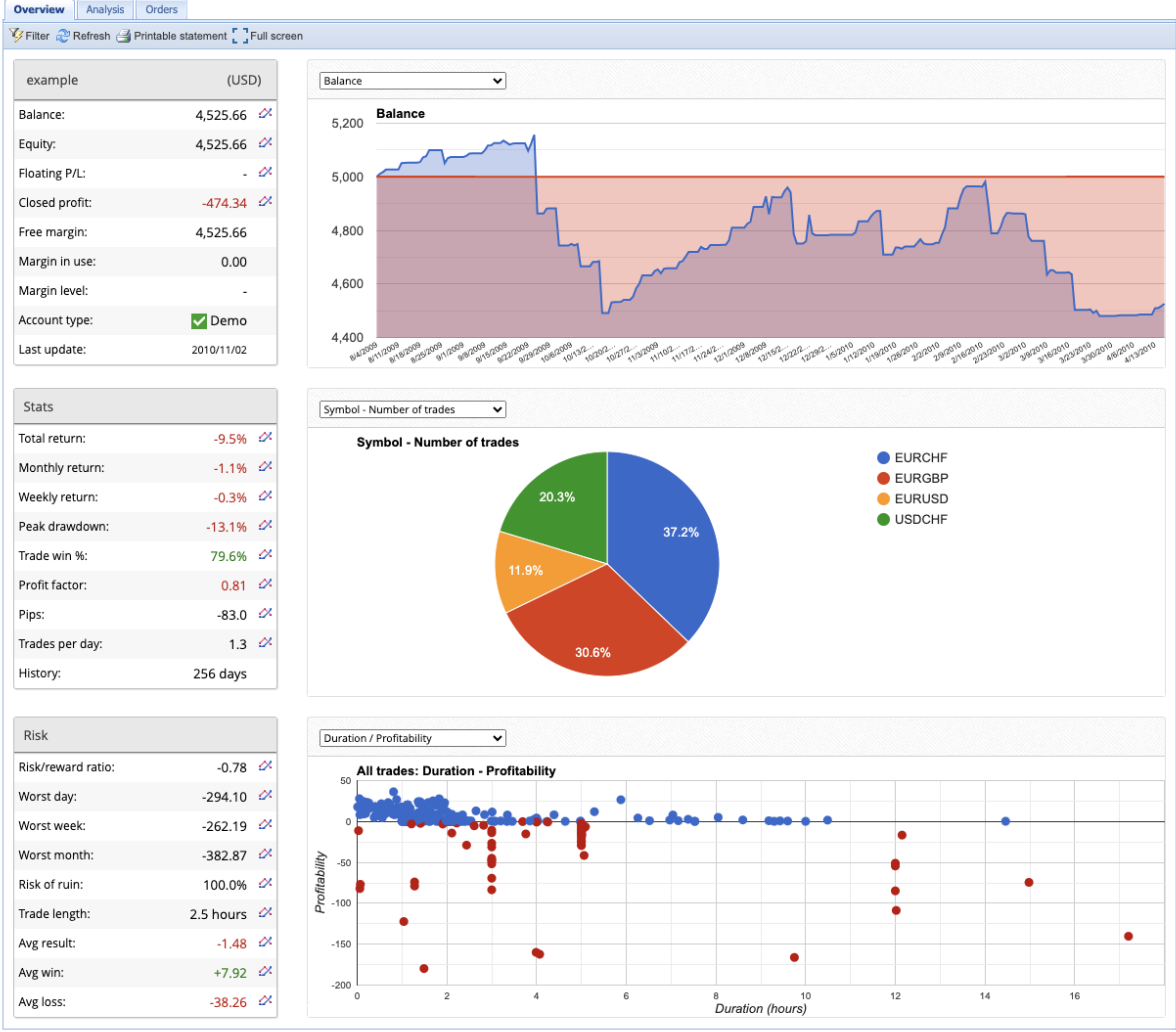

Analyse Your Trading Account

FX Blue Live is a free web-based service for analyzing and publishing your trading history. Publication is almost instant after trading activity, with updates as frequently as every 60 seconds while trades are active. You can combine accounts into portfolios, embed full results and analysis on your own website, or collect your history using our APIs.

Figaro App Suite for MT4/5

20+ Tools in One Place

The Figaro app suite gives you unrivalled trading power and information inside the MT4 and MT5 desktop client terminal: currency strength, quote board and deal tickets, trade grid and card view, real-time sentiment, market scanner, calculators, premium charting.

The Figaro app suite gives you unrivalled trading power and information inside the MT4 and MT5 desktop client terminal: currency strength, quote board and deal tickets, trade grid and card view, real-time sentiment, market scanner, calculators, premium charting.

Trade copiers, simulators, and more...

Free apps provided by FX Blue for traders and software developers, including our hugely popular Personal Trade Copier and Trading Simulator.

Personal Trade Copier

The Personal Trade Copier duplicates orders between installations of MT4 and/or MT5 running on the same computer.

Trading Simulator

The FX Blue Trading Simulator converts the MT4/5 strategy tester into a tool for practising manual trading using historic data.

Internet Trade Mirror

The FX Blue Internet Trade Mirror copies trades between different MT4 and/or MT5 accounts over the internet.

Trading Challenges

Take a free trading challenge before you pay an entry fee to a prop trading firm, or just practise trading with an open-ended demo account from FX Blue.

No broker registration! And no downloads - trade from your browser or phone.

You can set up a trading challenge for yourself, with your choice of duration and target. The system automatically tracks your performance, and notifies you when the challenge succeeds or fails. You can follow your tick-by-tick progress on this website or in the trading platform. Try out your trading skills before paying entry fees to prop trading firms - or just practice for fun.

Challenge accounts have a duration, a target, and a maximum loss. There can also be a separate limit on the maximum daily loss.

FX Blue also offers regular demo accounts. These have no fixed duration or target. You can use them for general, open-ended trading practice.

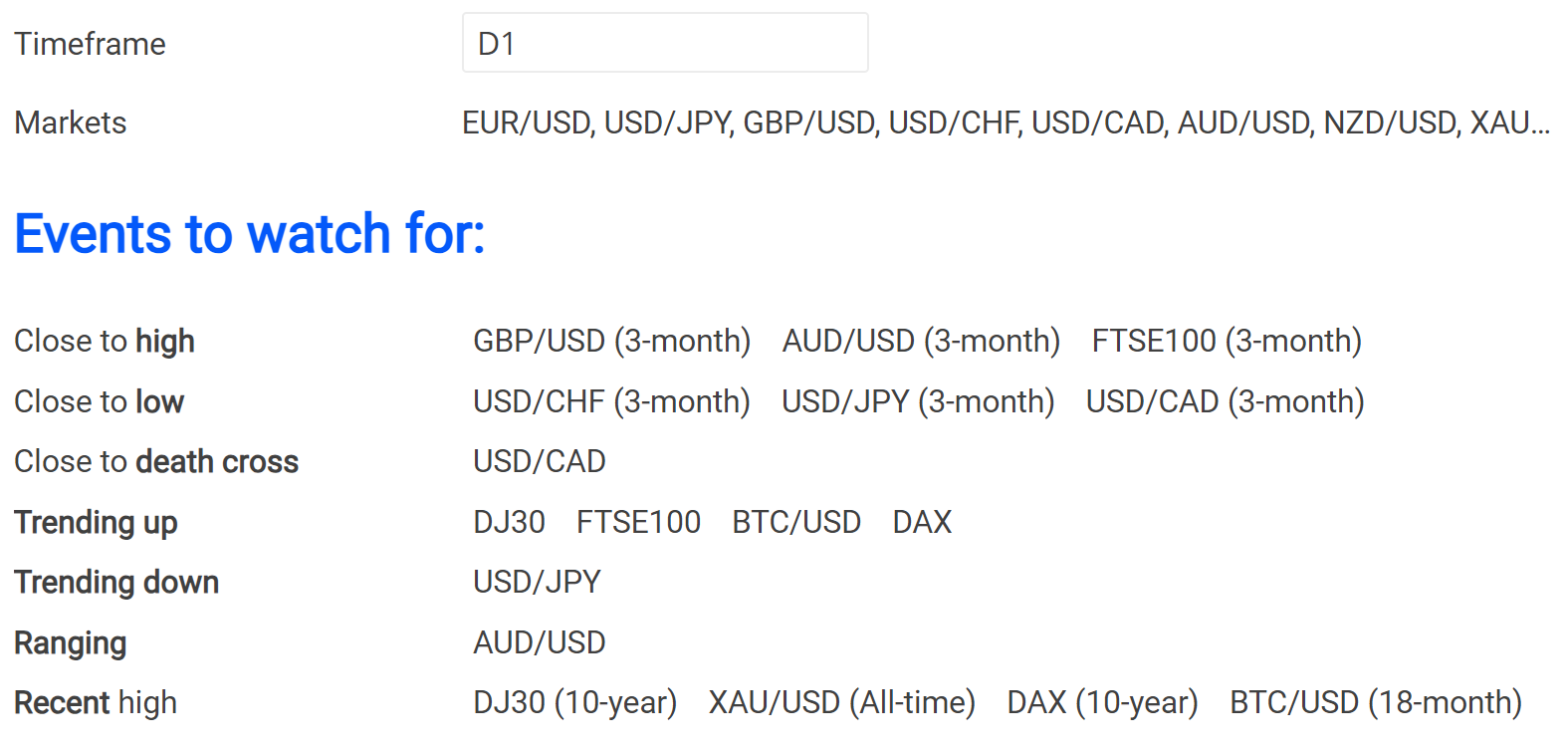

Future Events Scanner

The scanner looks for events which are close to happening, such as new highs and lows, and which may cause a reaction in the market. The scanner currently looks for highs and lows, golden and death crosses, band breakouts, swing points, and strongly trending or ranging markets.

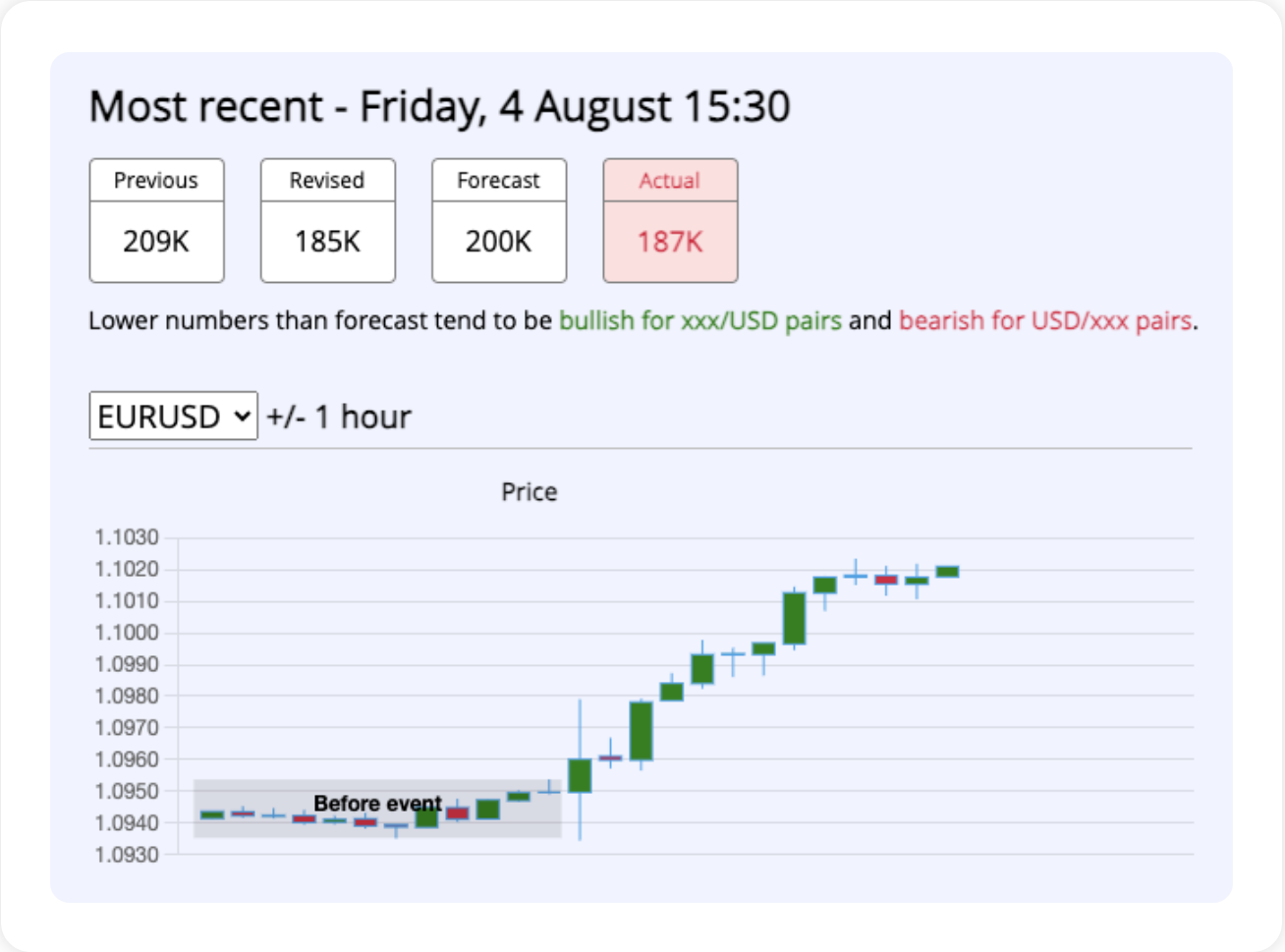

Nonfarm Payrolls (NFP)

Nonfarm Payrolls (NFP) is the most potent regular event in the economic calendar, with prices often moving by over 100 pips in a few minutes. The health of the US labor market affects decisions of the Federal Reserve, which in turn move exchange rates. The expected/forecast value of NFP is usually priced in to markets, and what they mainly react to is the "surprise factor": any difference from expectation/forecast, rather than the change since the previous month.

Keep track of NFP using our economic calendar, with the unique ability to re-play the market reaction to previous announcements, watching how the "surprise factor" has moved price and market sentiment in the past - and how it may do so again in future.